non filing of income tax return consequences

If you missed the due date here are some consequences of not filing an income tax return that NRIs may face. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years.

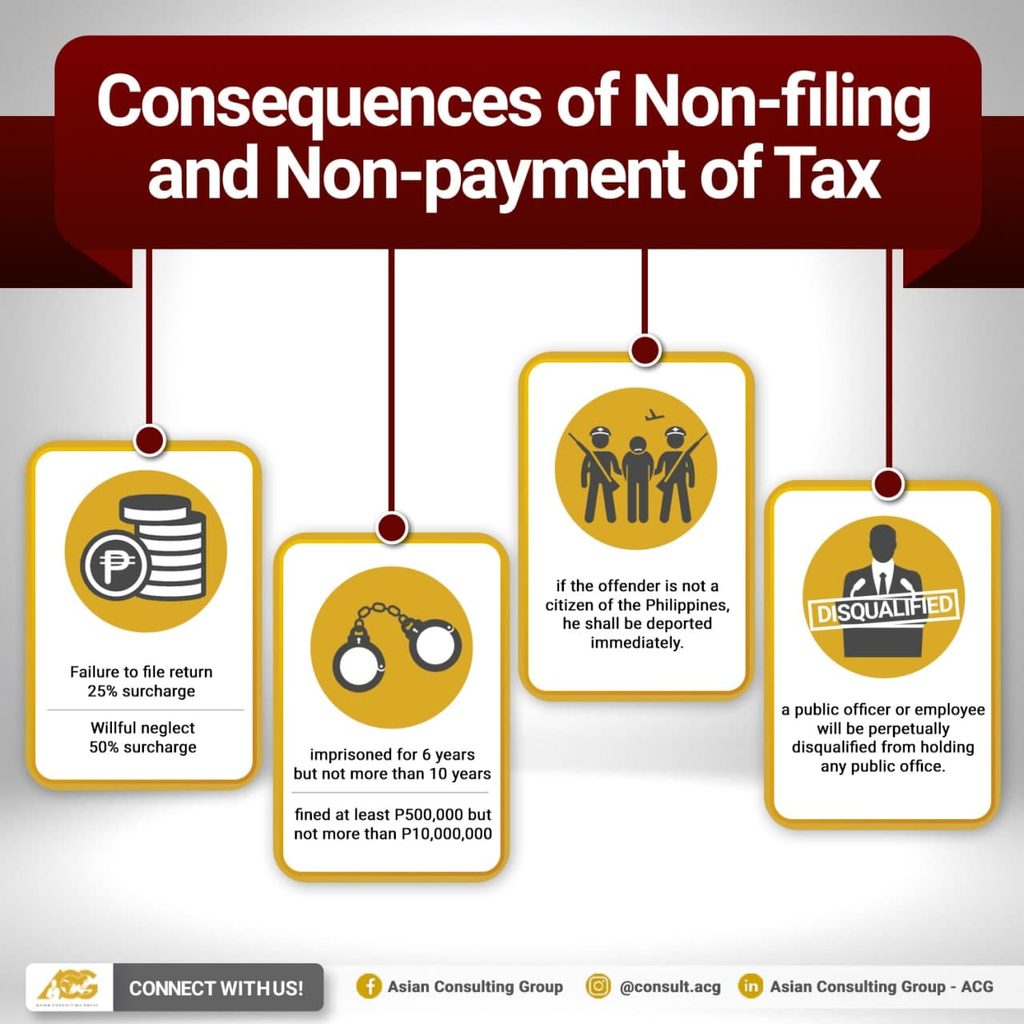

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

If you do not file a return and there is assessable income you are liable to a penalty for concealment of income which ranges from 100 to 300.

. Ignoring bills and notices from the IRS can lead to a determination of tax evasion. If you have already filed the return or manage to file it before the due. If you owe taxes and fail to pay them you could face penalties for failure to pay.

Every year the IRS and the media put out lots of information and reminders about the due date for filing your federal tax return. Levy of interest penalty. Form 502 Resident Return Taxpayer who began or ended legal residence in Maryland during the tax year you must file as a resident for that portion of the will emergency snap.

This happens when wilfull default to furnish the return of income and tax payable after reducing taxes paid and TDS exceeds Rs 10000. The due date for income tax return ITR filing for the financial year 2021-22 or assessment year 2022-23 is July 31 2022. If the taxpayer fails to comply with all the terms of a notice issued under section 143 2 Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment.

Hence even if your income falls under basic exemption limit you might be under the list of. Consequences of non-filing of Income Tax Return. Pay 0 to File all Federal Tax Returns Claim the credits you deserve.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Consequences of Non-payment of withholding tax. As per the provisions of Indian domestic tax laws every entity including foreign entities in receipt of any income is required to file its Income- tax return in India.

The due date of filing the return of income by a NRI is July 31st. Consequences for non-filing of a tax return in India. The foremost impact of not filing ITR is a penal interest of 1 is charged us 234A of the Income Tax Act 1961 for default in payment of tax by the due date.

May lead to Best judgment assessment by the AO us 144. Ad Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. If individuals file their returns after the last date of filing Return of Income they will be charged interest at the rate of 1 per month of delay.

Consequences Of Not Filing. Penalties for non - deduction and failure to pay deducted tax to the government that may result in a minimum penalty. The consequences of not filing a personal income tax return include fines liens and even imprisonment.

In case of companies not filing ITR the principal officers of the firms including directors will be punishable with rigorous imprisonment and a fine irrespective of whether any tax is payable by the company Chandwani explains. Prescribed penalty plus imprisonment of at least 3. Tax evasion is a serious offense that will leave you with a court hearing marks on your credit and a criminal record.

It is mandatory on part of every individual to file the Income Tax Return and also the person will be penalized under section 234A of the Income Tax Act. This is an assessment carried out as per the best judgment of the Assessing Officer on the basis of all relevant material he has gathered. Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties.

Failing to file a tax return when you make above a certain amount. The penal interest is charged in addition to the normal interest on tax. Section 255 also imposes a compromise penalty of not less than P10000 and imprisonment of not less than 1 year but not more than 10.

For possible tax evasion exceeding Rs25 lakhs. AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1. Consequences for non-filing of a tax return in India October 2018.

Further if such a return is filed after one year from the end of the tax year concerned apart from the interest they will also be liable for a penalty of Rs 5000. Owing to the lack of awareness or otherwise the Indian Government has observed that many entities. Ad Use our tax forgiveness calculator to estimate potential relief available.

The specifics regarding imprisonment are as follows. Carry forward of Losses not allowed except in few exceptional cases. New Powers of FBRDisabling of Mobile SimsDisconnection of Electricity MeterDisconnection of Gas Meters along with other penalties on non return filersSeek.

In case an assessee has taxable income but fails to file return of income the consequence may be sever especially if the motive of non-filing is tax evasion.

What Is Tcs Calculator Income Tax Return Income Tax Tax Payment

What Happens When A Taxpayer Do Not File Taxes Filing Taxes Tax Preparation Services Income Tax Return

The Season For Income Tax Returns Is Around The Corner And You All Must Be Gearing Up To File Your Income Tax While Fi Income Tax Income Tax Return Tax Return

Fact Doyouknow Knowyourrights Law Food Foodtem Notinagoodcondition Jail Taxolawgy Justiceforall Social Cause Freelancing Jobs Facts

Income Tax Filing India Itr Filing Taxation Policy In India

For How Many Previous Years A Taxpayer Can File Income Tax Return Income Tax Return Income Tax Tax Return

1 43 Pm 12 14 2019 Hamna Only A Filer Can Purchase Property Worth More Than Rs 5 000 000 A Non Filer Can N Income Tax Return Tax Return File Income Tax

Consequences Of Non Or Late Filing Of The Income Tax Return

Tds Return Filing Types Of Tds Returns Online Filing

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

Pin On Best Of Canadian Budget Binder

Is There A Penalty For Filing Taxes Late If You Don T Owe Late Tax Filing Liu Associates Edmonton Calgary

Penalty For Late Filing Of Income Tax Return For Ay 2020 21 Income Tax Return Income Tax Tax Return

Consequences Of Filing A Late Income Tax Return Income Tax Return Income Tax Tax Return